Ultimate Guide to Manage Exness Account Effectively

Managing your Exness account is crucial for achieving your financial objectives and ensuring a smooth trading experience. Whether you are a new trader looking to understand the basics or an experienced trader seeking advanced strategies, this guide will offer valuable insights into how to effectively manage your account on Exness. For beginners, there are various resources available online, such as manage Exness account https://thewealthlounge.com/trading-patterns-on-exness-27/, which can help you get started.

Understanding Your Exness Account

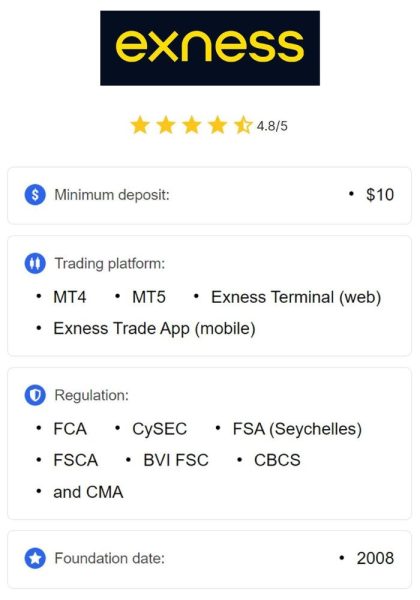

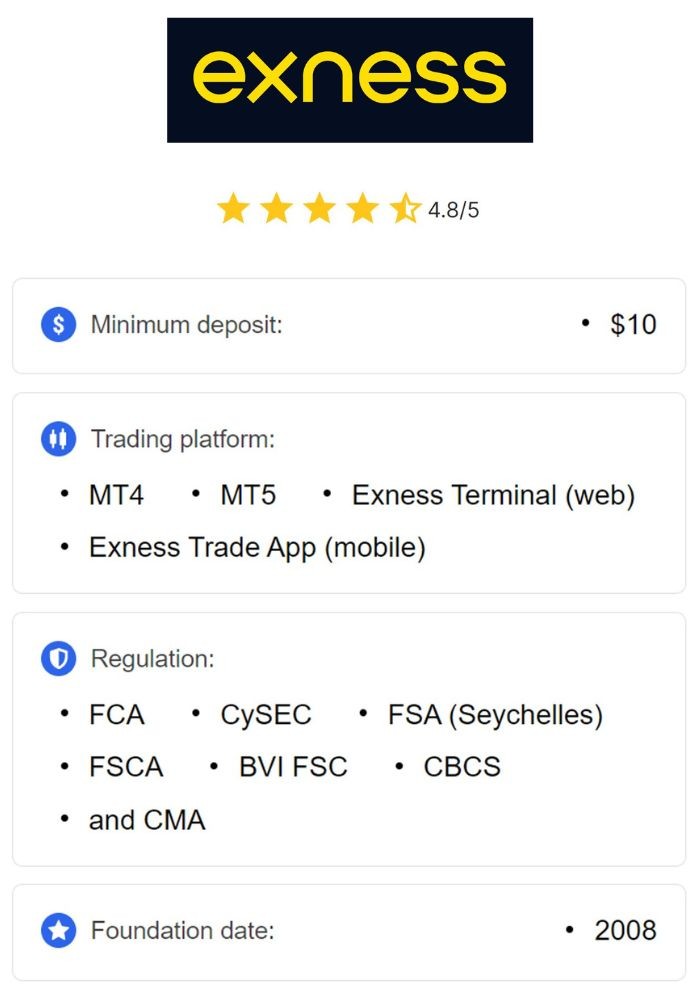

Your Exness account serves as the gateway to the financial markets, allowing you to trade various instruments, from forex to commodities. It is essential to familiarize yourself with the different types of accounts Exness offers, including Standard, Pro, and Zero accounts, each with its unique features and benefits.

Account Types

1. **Standard Account**: This account type is ideal for beginners. It offers access to a wide variety of trading instruments with a user-friendly interface and competitive spreads.

2. **Pro Account**: Best suited for more experienced traders, the Pro account provides tighter spreads and faster execution speeds, making it perfect for high-frequency trading.

3. **Zero Account**: As the name suggests, this account comes with zero spreads, though it charges a commission per trade. This account is tailored for professional traders who seek to make precise trades without spread-related anomalies.

Setting Up Your Exness Account

To effectively manage your Exness account, the first step is setting it up correctly. Sign up on their official website, and complete the verification process to ensure that your account is secure and compliant with regulatory standards.

Verification Process

Exness typically requires traders to verify their identity to comply with international law. This process includes submitting valid identification documents, such as a passport or driver’s license, and proof of address, like a utility bill or bank statement. Once verified, you can fund your account and start trading.

Funding Your Exness Account

After setting up your account, you need to fund it before you can begin trading. Exness supports various payment methods, including credit cards, bank transfers, and e-wallets. Choose a method that is convenient for you and offers minimal fees.

Deposits and Withdrawals

Depositing funds is usually straightforward, with instant processing for most payment methods. Keep in mind the minimum deposit requirements for the type of account you have selected. Withdrawals are equally straightforward, and Exness is known for its prompt processing times, allowing you to access your funds when you need them.

Trading Strategies for Exness

To maximize your success on Exness, you need to implement effective trading strategies. Here are some popular strategies that can help you make informed decisions:

1. Day Trading

Day trading involves opening and closing trades within the same trading day. This strategy requires a good understanding of market volatility and the ability to react quickly to market fluctuations.

2. Swing Trading

Swing trading focuses on capturing short- to medium-term gains over several days or weeks. Traders using this strategy typically analyze trends and market patterns to make informed decisions about entry and exit points.

3. Scalping

Scalping is a high-frequency trading strategy that aims to profit from small price changes. This requires a disciplined approach and quick execution capabilities, which Exness supports with its low-latency trading platforms.

Risk Management

One of the critical aspects of managing your Exness account is understanding and implementing effective risk management practices. This ensures that you protect your trading capital and minimize potential losses.

Setting Stop-Loss and Take-Profit Levels

Always set stop-loss and take-profit orders before entering a trade. This helps safeguard your investments and ensures that your trading plan is adhered to consistently, regardless of market emotions.

Position Sizing

Determining the right size for your trading position based on your risk tolerance is essential. Many traders utilize the rule of not risking more than 1-2% of their trading capital on a single trade. This approach helps ensure longevity in trading.

Keeping Track of Performance

To manage your Exness account effectively, you need to track your trading performance. Keeping a detailed trading journal helps you analyze your trades and identify patterns in your trading behavior.

Analyzing Winning and Losing Trades

Regularly review your winning and losing trades to understand what strategies work and which need improvement. This analysis can provide insights that will refine your trading methods and enhance your overall profitability.

Conclusion

Managing your Exness account effectively is paramount for success in trading. By understanding different account types, implementing effective strategies, and practicing sound risk management techniques, you prepare yourself for a positive trading experience. Always stay updated on market trends to improve your decision-making process and continuously grow your trading skills.

As you get more comfortable with your account management, consider exploring advanced trading tools and resources offered by Exness to further enhance your trading experience.